We are featuring an important new article by Richard Ennis, the co-founder of the first professional investment consultancy, EnnisKrupp, and editor of the Financial Analysts Journal. As we’ll explain shortly, Ennis continues with his criticism of fundamental flaws in the orthodox, and pretty much pervasive, approach large investors use for structuring and managing their portfolios. Ennis, who is unusually well-qualified to make an assessment, deems this strategy to be inherently flawed and describes what he views as superior approach.

We’ve embedded his paper at the end of this post and encourage you to read it in full.

While we are very much taken with Ennis’ critique, we have to confess to be less keen about his remedy. It is likely to reduce expenditures on chasing returns, but we are skeptical that large investors can generate alpha, particularly collectively.

By way of background, the prestigious Journal of Portfolio Management published another devastating piece by Ennis earlier this year, which we also encourage you to read. From our summary of its major findings:

We are embedding an important new study by Richard Ennis, in the authoritative Journal of Portfolio Management,1 on the performance of 46 public pension funds, including CalPERS, as well as of educational endowments.

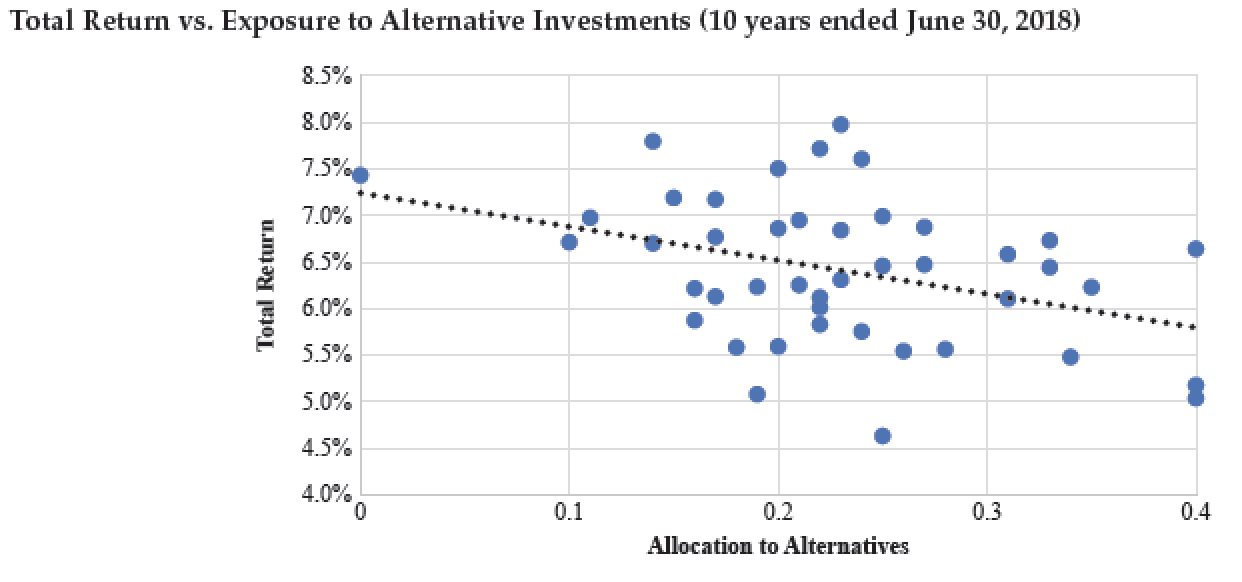

Ennis’ conclusions are damning. Both the pension funds and the endowments generated negative alpha, meaning their investment programs destroyed value compared to purely passive investing.

Educational endowments did even worse than public pension funds due to their higher commitment level to “alternative” investments like private equity and real estate. Ennis explains that these types of investments merely resulted in “overdiversification.” Since 2009, they have become so highly correlated with stock and bond markets that they have not added value to investment portfolios. From the article:

Alternative investments ceased to be diversifiers in the 2000s and have become a significant drag on institutional fund performance. Public pension funds underperformed passive investment by 1.0% a year over a recent decade…

For a decade [starting in 2009], stock and bond indexes have captured the return-variability characteristics of alternative investments in composites of institutional funds, for all intents and purposes. Alternative investments did not have a meaningful effect. The finding that the correlation between funds with significant alts exposure and marketable securities benchmarks is near perfect runs counter to the popular notion that the return properties of alts differ materially from those of stocks and bonds. That, after all, is an oft-cited reason for incorporating alternative investments in institutional portfolios. As we see here, however, alt returns simply blend into broad market returns in the context of standard portfolio analysis in the latter decade.

Needless to say, this finding also shows the folly of CalPERS’ plan to pile on risk by investing even more in private equity and plunge into private debt.

As the extract above indicates, Ennis found the median cost of the mismanagement by the 46 public pension funds as roughly 1% per year. CalPERS is a standout in the “negative value added” category, ranking 43 out of 46, with a “negative alpha” of 2.36%. This is a particularly appalling scoring, since CalPERS has far and away the largest and best paid investment office of any US public pension fund. But is this outcome partly result of CalPERS paying its investment team for merely showing up? The investment office staff perversely receives performance bonuses for merely almosthitting their benchmarks, which means achieving what CalPERS has defined as “market” performance. As we’ll discuss soon, Ennis describes how those benchmarks are self-serving and more favorable than using simple, broad stock and bond market proxies.2

Ennis explains that the public pension fund underperformance appears to be explained almost entirely by higher investment costs.

Back to the current post. In his latest article, Ennis further develops and substantiates his “overdiversification” thesis:

Trustees of public pension funds and large endowments in the U.S. are in a bind. With the help of staff, consultants, asset managers, assorted pundits and a media chorus, they have rationalized the division of their portfolios into as many as a dozen different sub-portfolios, commonly known as asset classes. Additionally, they behave as if they believe they can beat the market with 100 or more asset managers, which they compensate to the tune of 1-2% of the value of their assets each year. None of this is working for them, and certainly it is not working for the stakeholders of these funds. Ennis (2020) found that public pension funds collectively have underperformed passive investment by 1.0% per year and large endowments by 1.6% per year. It is time for fiduciaries to recognize that they have not merely been unlucky. Rather, their strategy has failed them.

CalPERS fits this picture, with roughly 100 managers in its private equity program alone.

Ennis points out that most of the so-called asset classes aren’t, since they don’t offer diversification beyond holding stocks and bonds.1 Instead, these other “asset classes” are “alternative investments” like private equity, venture capital, hedge funds, and real estate. Ennis explains that these are active strategies and investors are seeking to generate alpha.

The problem is that they once did and now don’t. The “Golden Age” of alternative investments was from 1994 to 2008. It would probably have overloaded the article to elaborate, but the vintage years 1994 through 1999 were spectacular for private equity, due largely to the wipeout that had come in the late 1980s and early 1990s. The losses were so widespread that the leveraged buyout industry felt compelled to distance itself from them by rebranding its activities as “private equity”. The years of disfavor meant that there had been a big falloff in buying private companies, as well as less competition for spinoffs of corporate divisions, creating buying opportunities. And “leveraged buyouts” had been tarnished badly enough that it took a few years of success for the money to start rolling back in in a big way.

The lifespan of this trend got a boost from the dot-bomb era, when Greenspan kept real interest rates negative for a then-unprecedented nine quarters. Investors, particularly long-term investors, started reaching for return, and private equity and hedge funds were among the preferred targets. More money pursuing these approaches initially bid up the assets they invested in.

So while the Ennis analysis is persuasive, I’m less taken with his prescription. It’s clearly an improvement from the status quo; my concern is that he oversells it in an effort to overcome institutional inertia. From his abstract:

We propose an alternative approach that employs just two asset classes: a versatile Passive Core and a flexible, efficient Active Portfolio. The Active Portfolio is where the action takes place. Here there are no asset-class silos to be filled and diversified; silos merely serve as constraints in selecting the most promising investments. The proposed approach maximizes freedom of choice, while enabling the investor to reconcile (1) the need for diversification, (2) scarce mispricing opportunities and (3) cost.

So far, so good. Ennis is quite serious about the Passive Core and tells investors with $1 billion or more that they should be spending no more than 1 basis point on this component of their strategy.

The problem I have is with the Active Portfolio. Ennis urges investors to go forth and seek alpha. I don’t see how this can realistically be done even on a single investor basis in an environment of financial repression, aka super low interest rates resulting in nosebleed valuation levels everywhere you look. You have historical situations where investors have effectively done what Ennis preaches without publicizing it widely. For instance, the success of the Yale endowment was based largely on making outsized bets on Chinese venture capital plays in the early and mid 2000s, due to making use of alumni connections, so they got currency appreciation, very strong fundamental growth, plus a strong record of making astute bets on particular companies.

Ennis first mistakenly believes that there is persistence in alternative investment top quartile performance. As we’ve been writing for at least the last 5 years, this hasn’t been true in private equity since the mid 2000s. It may still be true for a thin slice of top venture capital firms, but even they don’t necessarily let investors benefit. For instance, Sequoia’s flagship fund reportedly is a persistent top performer. But investors in the Sequoia flagship fund are required to invest in its doggier European and Asian funds, dragging down overall returns.

Ennis secondly believes in a terribly hostile environment, it is nevertheless possible to find superstars. Good luck with that. We addressed this fallacy back in 2014. You can substitute “alternative investments” for “private equity” and come to the same conclusion:

When you boil it down, this graph illustrates the ugly truth of investing in private equity: it’s not attractive unless you can outrun most of your peers investing in the asset class.

Rather than question the logic of investing in private equity at all, everyone in the industry has convinced themselves that it is reasonable to believe that they can be the Warren Buffett of private equity. The investment consultants go through the shooting-fish-in-a-barrel exercise of convincing their institutional clients that each of them is prettier, smarter, and more charming than average, and therefore capable of achieving sparking results. Needless to say, flattery is an easy sell….

Fundamentally, this is an intellectually dishonest exercise, and diametrically opposed to the way many public pension funds construct other parts of their investment portfolios. With public equity in particular, it’s almost certain that a significant majority of U.S. pension fund assets are invested in index funds. That’s because pension funds have recognized that, collectively, they cannot do better than average, and that after paying active management fees, actively managed public equity portfolios typically perform worse than the market average.

So it’s not as if these investors are so clueless that they can’t grasp the point that all of them cannot achieve above average results, let alone significantly above average results. Instead, with private equity, there is a desperate desire to be in the asset class for reasons that probably reflect a combination of intellectual capture by the PE managers, political corruption in legislatures that control public fund board appointees, and the need to have a strategy that could conceivably solve the pension underfunding problem over time.

Ennis recommends getting an advantage by hiring an experienced Chief Investment Officer who will in turn hire well-paid, in-house “scouts” to find superior investment managers. At least this gets rid of reliance on overpriced consultants. However, per the discussion above, there’s no evidence these super-managers who consistently outperform exist. Moreover, if they did, the first place they’d go to work is for a family office, where they would have better pay opportunities and less bureaucracy than working for an institutional investor (the exception would be a prestigious endowment, where success could be a stepping stone to launching one’s own fund).

In other words, Ennis appeared to lack the strength of his convictions to follow where his data led: to tell institutional investors to give up on the chasing alpha game, determine the level of risk they wanted to assume, and construct the cheapest indexing strategy possible consistent with that. Now there may be a role for opportunism, but it takes the discipline to sit around doing nothing until there’s blood in the streets, and then jump in and take big risks. Ironically, this was one of departed CalPERS CIO Ben Meng’s few sound ideas, but given his lack of experience running money, it’s not clear he had the temperament to execute it well.

____

1 One could argue that before the crisis, hedge funds offered a return profile not that much correlated with stocks. We pointed out at the time that hedge fund manager were even conceding that they weren’t generating alpha but instead “alternative beta”. We noted then that there was no justification for paying “2 and 20” merely for differentiated return profiles; you could create it vastly cheaper via other means.