This is Naked Capitalism fundraising week. 1154 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our current goal, burnout prevention.

We warned you from the get-go that Bitcoin = prosecution futures. The IRS is in the process of making that even more so that it was. Speculators who have been treating cryptocurrency as a license not to pay taxes face a rude awakening.

We described in 2014 how the IRS had ruled that Bitcoin and other cryptocurrencies were tradeable property, meaning that gains and losses upon sale would be taxable events. As we wrote then:

More important, the fact that Bitcoin is property means it can be taxed at short or long term capital gains rates, or as ordinary income, depending on the holding period of the Bitcoins in question and the status of the holder (investor v. trader v. Bitcoin miner v. business accepting Bitcoin as payment). The record-keeping burden of having to track Bitcon prices against the dollar at the time of acquisition versus the time of use will be a substantial deterrent to their use in commerce.

And we also warned in 2018 that the IRS was cracking down, in Bitcoin as Prosecution Futures: Coinbase Agrees to Turn Customer Records Over to Department of Justice for Possible Tax Evasion:

Even in the US, which so far has been more lenient toward cryptocurrencies than China, the noose is tightening. Top Bitcoin exchange Coinbase has decided that trying to defy the law, in terms of not complying with a IRS summons requiring it to turn over information about customers who had engaged in more than $20,000 in Bitcoin transactions in a year, was not a viable position. Apparently Coinbase had had the Silicon Valley libertarian chutzpah to think the rules didn’t apply to them. The IRS does not regard “disruption” as a tax exemption.

Bizarrely, many people who use Bitcoin and other cryptocurrencies labor under the delusion that those transactions aren’t subject to tax reporting and tax compliance. As we reported at the time, in 2014, the IRS determined that Bitcoin was property, not a currency. That meant that gains on trading in Bitcoin are taxable the same way gains on trading in currency futures or selling a piece of land are.1 That means, and that means you, those transactions are reportable as income for US taxpayers.

The supposed virtue of cryptocurrencies like Bitcoin is their Achilles heel as far as hiding from the taxman is concerned. The famed blockchain contains the full ledger for each coin, meaning the history of all transactions, and that record cannot be altered. The blockchain contains the date and time and the amount of each transaction, as well as the unique identifier for the wallet associated with that transaction. Knowing the wallet does not get you to the holder of the wallet, but it gets you a fair bit of the way there. As Lee Sheppard pointed out in Tax Notes last year:

Moreover, many transactions are now settled off the blockchain and never recorded there. The exchange that processed the transactions would have the only records. From an investigatory standpoint, the blockchain’s limitations and the widespread practice of off-chain clearing combine to make the blockchain more like the Depository Trust Company, which holds publicly traded shares on behalf of brokers, who control information about beneficial owners. To find the owner, it is necessary to sue the intermediary in each case.

That isn’t as far-fetched as you might think.

The US Treasury’s Financial Crimes Enforcement Network had stated that cryptocurrency exchanges are money service businesses because they often convert the cryptocurrencies into money. That means in pretty much all cases they are obliged to register and to comply with anti-money laundering rules.

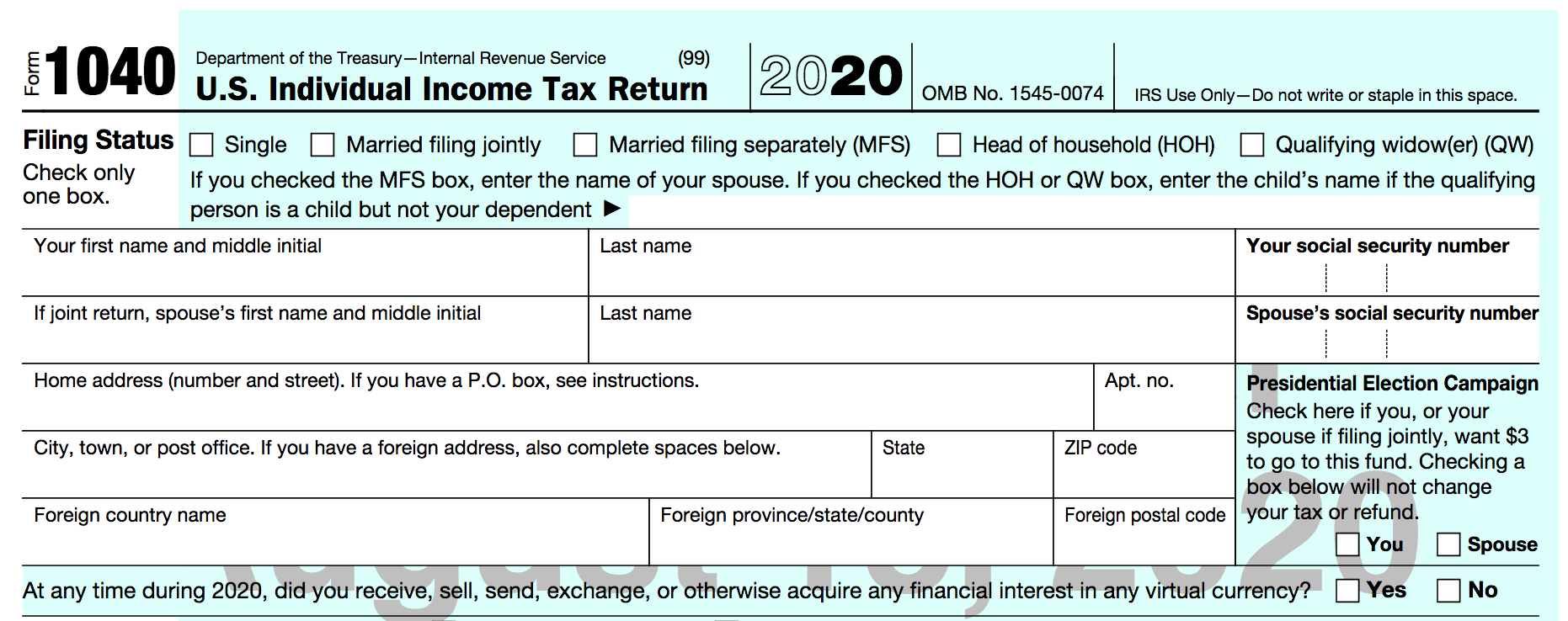

The IRS is turning the heat up even higher on cryptocurrency users. For 2020 individual tax returns, the agency has, as its most prominent question, whether filers had dabbled in cryptocurrencies, which it calls “virtual currencies”:

The Wall Street Journal, in a thorough piece, explains that this placement is designed to set up prosecutions:

The IRS’s move is a strong warning to millions of crypto holders who aren’t complying with the law that they must file required forms they may see as burdensome and pay taxes they may think are unfair. It has impressed tax specialists.

“This placement is unprecedented and will make it easier for the IRS to win cases against taxpayers who check ‘No’ when they should check ‘Yes,’” says Ed Zollars, a CPA with Kaplan Financial Education who updates tax professionals on legal developments.

Mr. Zollars notes that U.S. tax authorities have already succeeded with a similar strategy: A simple tax-return question about offshore financial accounts greatly aided their crackdown on Americans hiding money abroad. Since 2009, it has brought in more than $12 billion from individuals.

The story describes how cryptocurrencies have become popular, with Coinbase reporting 35 million accounts as of July and Chainalysis, a cryptocurrency investigations software firm, estimated US Bitcoin users alone from June 2019 to June 2020 at 3.1 million or more. It also describes how the IRS provided cryptocurrency assistance in prosecutions, such as of a Dutch child pornographer.

And that’s not all. Again from the Journal:

Meanwhile, the IRS is forging ahead with other crypto compliance measures. Earlier this month, it offered rewards up to $625,000 to code-breakers who can crack so-called privacy coins like Monero that attract illicit activity because they claim to be untraceable.

In late August, the agency released guidance affirming that taxpayers who receive crypto for completing “microtasks” must declare it as income. This applies to users of firms like StormX, which makes tiny payments in crypto to people who do small tasks such as playing games, answering surveys, or evaluating products.

Given how vocal cryptocurrency users seem to be (based on our experience in the comments section), it was instructive to see comments in the Wall Street Journal skew slightly in favor of the IRS. The main beef was about how it was difficult and therefore unfair to make cryptocurrency uses account for their transactions. One reader dealt with that nicely:

Bill Taylor

There are lots of transactions for which the tax accounting is complicated. The problem with crypto currency is the number of unsophisticated owners. People buy this stuff not understanding how it works and then complain. It’s like complaining about noise after buying a house next to the airport.

Frankly, the only thing surprising about this move it is took so long for the IRS to get around to it.