The coronavirus pandemic, social distancing, and resulting economic downturn have had considerable implications for the U.S. health system, including health insurers. The pandemic caused a sizable decrease in the use of health care services during the first half of 2020, job losses appear to have led to coverage loss in the employer market and increases in Medicaid enrollment, and insurers projecting costs for next year must assess the relative effects of pent-up demand for delayed care, the continuing pandemic, and a potential vaccine.

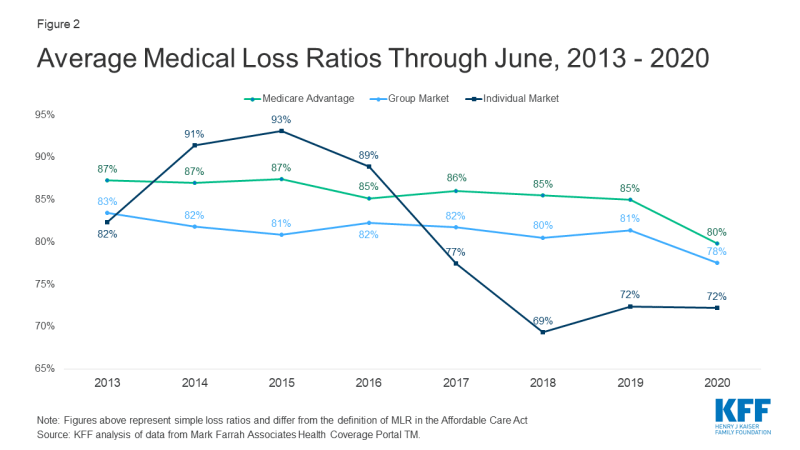

In this brief, we analyze data from 2013 to 2020 to examine how insurance markets performed through the first half of this year as the pandemic developed and worsened in the U.S. We use financial data reported by insurance companies to the National Association of Insurance Commissioners and compiled by Mark Farrah Associates to look at average medical loss ratios and gross margins in the individual (also known as non-group), fully-insured group (employer), and Medicare Advantage health insurance markets. A more detailed description of each market is included in the Appendix.

We find that, as of the end of June 2020, average margins have increased and loss ratios have dropped across the fully-insured group and Medicare Advantage markets, relative to the same time period in 2019. If administrative costs were roughly the same in 2020 as in 2019, these findings suggest higher profits for many insurers during the pandemic. Individual market loss ratios were already quite low and remained flat into 2020, suggesting continued profitability. The results for the individual and group markets indicate that commercial insurers are on track to owe substantial rebates to consumers again next year under the Affordable Care Act (ACA) Medical Loss Ratio provision.

Gross Margins

One way to assess insurer financial performance is to examine average gross margins per member per month, or the average amount by which premium income exceeds claims costs per enrollee in a given month. Gross margins are an indicator of performance, but positive margins do not necessarily translate into profitability since they do not account for administrative expenses. However, a sharp increase in margins from one year to the next, without a commensurate increase in administrative costs, would indicate that these health insurance markets have become more profitable during the pandemic.

Despite many insurers covering the full cost of coronavirus testing and treatment for their enrollees, insurers across most markets have seen their claims costs fall, and margins increase since the start of the pandemic, and relative to 2019. This is consistent with the sharp drop in utilization documented in other analyses.

Gross margins among group market plans increased 22% (or $20 pmpm) through the second quarter of 2020 relative to the same period in 2019. Gross margins among Medicare Advantage plans also increased, rising 41% (or $64 pmpm) through the first six months of 2020 compared to gross margins at the same point last year. (Gross margins per member per month tend to be higher for Medicare Advantage than for the other health insurance markets mainly because Medicare covers an older, sicker population with higher average costs). Prior to the pandemic, margins in the group and Medicare Advantage markets had grown gradually over recent years.

Individual market margins have been more volatile than the other private markets since the early years of the Affordable Care Act (ACA), as described in more depth in our earlier analyses of individual market financial performance. Individual market margins remained relatively stable through the first six months of 2020, decreasing just $4 per member per month, and remaining much higher than in the earlier years of the ACA. These data suggest that insurers in the individual market remain financially healthy after a year and a half with no individual mandate penalty, even while the coronavirus outbreak worsened.

Medical Loss Ratios

Another way to assess insurer financial performance is to look at medical loss ratios, which are the percent of premium income that insurers pay out in the form of medical claims. Generally, lower medical loss ratios mean that insurers have more income remaining, after paying medical costs, to use for administrative costs or keep as profits. Each health insurance market has different administrative needs and costs, so low loss ratios in one market do not necessarily mean that market is more profitable than another market. However, in a given market, if administrative costs hold mostly constant from one year to the next, a drop in loss ratios would imply that plans are becoming more profitable.

Medical loss ratios are used in state and federal insurance regulation in a variety of ways. In the commercial insurance (individual and group) markets, insurers must issue rebates to individuals and businesses if their loss ratios fail to reach minimum standards set by the ACA. Medicare Advantage insurers are required to report loss ratios at the contract level; they are also required to issue rebates to the federal government if they fall short of 85%, and are subject to additional penalties if they fail to meet loss ratio requirements for multiple consecutive years in a row.

The loss ratios shown in this issue brief differ from the definition of MLR in the ACA, which makes some adjustments for quality improvement and taxes, and do not account for reinsurance, risk corridors, or risk adjustment payments. The chart below shows simple medical loss ratios, or the share of premium income that insurers pay out in claims, without any modifications (Figure 2). Loss ratios in the Medicare Advantage market decreased 5 percentage points through the first six months of 2020 relative to the same period in 2019, and group market loss ratios decreased by an average of 3 percentage points relative to last year.

The individual market was the only market in which average loss ratios held steady from last year. Even so, loss ratios in the individual market were already quite low and insurers in that market are issuing record-large rebates to consumers based in part on their 2019 experience.

Discussion

Although we cannot measure profits directly, all signs suggest that health insurers in most markets have become more profitable so far during the pandemic. Medicare Advantage and group health plans saw rising margins and falling loss ratios through June 2020, relative to the same time last year. In contrast, margins and loss ratios among individual market insurers have generally remained flat through the second quarter compared to the same time last year, though insurers in this market already had high margins and low loss ratios last year.

That insurers appear to be becoming more profitable during a pandemic may be counter-intuitive. Insurers were generally required to cover COVID-19 testing costs, and many also voluntarily covered the full cost of COVID-19 treatment for a period of time (see for example, announcements from UnitedHealthcare, CVSHealth (Aetna), and Cigna). Even with these increased pandemic-related expenses, though, many insurers saw claims costs fall as enrollees delayed or went without other types of health care due to social distancing restrictions, cancelation of elective procedures, or out of fear of contracting the virus. Job losses and economic instability may also affect health care utilization.

The drop in utilization that has contributed to higher gross margins and lower medical loss ratios presents uncertainty and challenges for insurers, particularly given the unknown trajectory of the pandemic. For Medicare Advantage insurers, these trends may result in plans offering more benefits than they currently do, which are popular and attract enrollees. But if insurers fall short in meeting required loss ratio requirements for multiple years, they face additional penalties, including the possibility of being terminated. In the individual and group markets, insurers are reporting pandemic-related uncertainty as they set premiums for next year, and insurers are making different assumptions about the extent to which utilization will rebound or health costs will change due to factors like the potential for widespread vaccination.

Unless these patterns change substantially in late 2020, ACA medical loss ratio rebates in 2021 likely will be exceptionally large across commercial markets. Rebates to consumers are calculated using a three-year average of medical loss ratios, meaning that 2021 rebates will be based on insurer performance in 2018, 2019, and 2020. In the individual market in particular, insurers were quite profitable in 2018 and 2019, so even if 2020 turns out to be a more average year, these insurers will likely owe large rebates to consumers. Group market insurers may also owe larger rebates to employers and employees than plans have in typical years, as loss ratios have dropped substantially. This may, in part, explain why many commercial insurers have volunteered to cover COVID-19 treatment costs, waived telemedicine cost-sharing, or expanded mental health services during the pandemic. By increasing their claims costs, insurers can proactively increase loss ratios and owe smaller rebates next year.