Managed care plays a key role in the delivery of health care to Medicaid enrollees. With 69% of Medicaid beneficiaries enrolled in comprehensive managed care plans nationally, plans play a critical role in responding to the COVID-19 pandemic and in the fiscal implications for states. This brief describes 10 key themes related to the use of comprehensive, risk-based managed care in the Medicaid program and highlights data and trends related to MCO enrollment, the development of actuarial sound MCO capitation payments, service carve-ins, total state and federal spending on MCOs, MCO parent firms, enrollee access to care, and state and plan activity related to quality, value-based payments, and the social determinants of health. Understanding these trends provides important context for the role MCOs play in the Medicaid program overall as well as during the current COVID-19 public health emergency and related economic downturn.

1. Today, capitated managed care is the dominant way in which states deliver services to Medicaid enrollees.

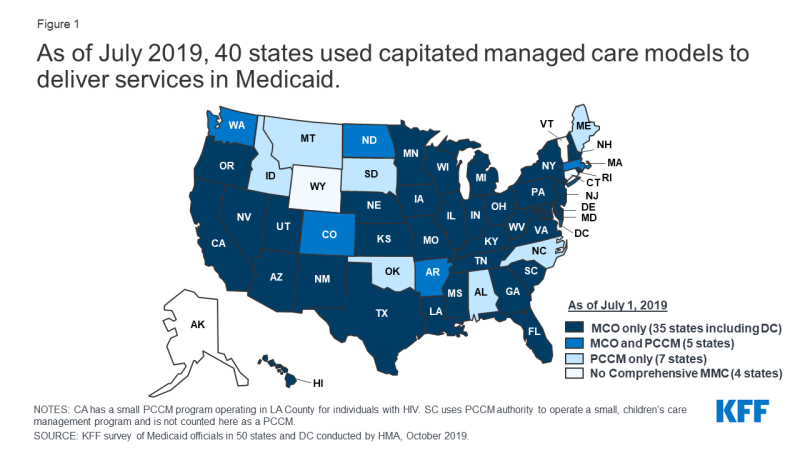

States design and administer their own Medicaid programs within federal rules. States determine how they will deliver and pay for care for Medicaid beneficiaries. Nearly all states have some form of managed care in place – comprehensive risk-based managed care and/or primary care case management (PCCM) programs., As of July 2019, 40 states, including DC, contract with comprehensive, risk-based managed care plans to provide care to at least some of their Medicaid beneficiaries (Figure 1). Medicaid managed care organizations (MCOs) provide comprehensive acute care and in some cases long-term services and supports to Medicaid beneficiaries. MCOs accept a set per member per month payment for these services and are at financial risk for the Medicaid services specified in their contracts. States have pursued risk-based contracting with managed care plans for different purposes, seeking to increase budget predictability, constrain Medicaid spending, improve access to care and value, and meet other objectives. While the shift to MCOs has increased budget predictability for states, the evidence about the impact of managed care on access to care and costs is both limited and mixed.3,

Figure 1: As of July 2019, 40 states used capitated managed care models to deliver services in Medicaid

2. Each year, states develop MCO capitation rates that must be actuarially sound and may include risk mitigation strategies.

States pay Medicaid managed care organizations (MCOs) a set per member per month payment for the Medicaid services specified in their contracts. Under federal law, payments to Medicaid MCOs must be actuarially sound. Actuarial soundness means that “the capitation rates are projected to provide for all reasonable, appropriate, and attainable costs that are required under the terms of the contract and for the operation of the managed care plan for the time period and the population covered under the terms of the contract.” Unlike fee-for-service (FFS), capitation provides upfront fixed payments to plans for expected utilization of covered services, administrative costs, and profit. Plan rates are usually set for a 12-month rating period and must be reviewed and approved by CMS each year. States may use a variety of mechanisms to adjust plan risk, incentivize plan performance, and ensure payments are not too high or too low, including risk sharing arrangements, risk and acuity adjustments, medical loss ratios (MLRs), or incentive and withhold arrangements.

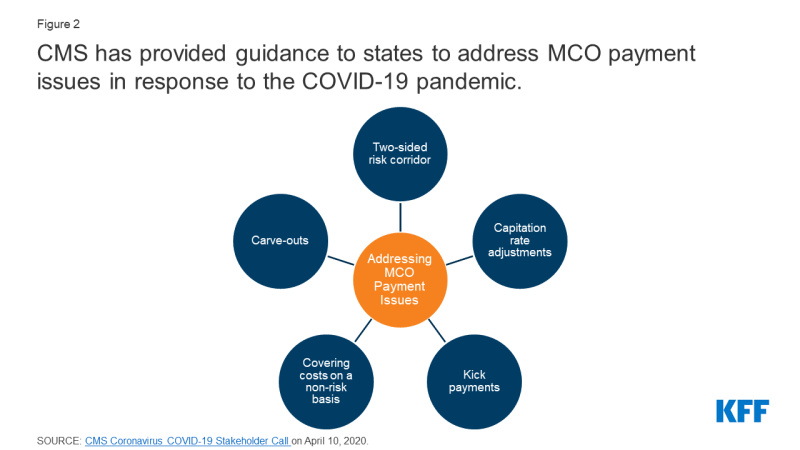

Current MCO capitation rates may have been developed and implemented prior to the onset of the COVID-19 pandemic. Consequently, these rates may not include costs for COVID-19 testing and treatment. At the same time, utilization of non-urgent care has decreased as individuals seek to limit risks/exposure to contracting the coronavirus. As a result, many states are evaluating options to make adjustments to existing MCO rates and risk sharing mechanisms in response to unanticipated COVID-19 costs and conditions that have led to decreased utilization. Under existing Medicaid managed care authority, states have several options to address payment issues that have arisen as a direct result of the COVID-19 pandemic. CMS has outlined state options to modify managed care contracts and rates in response to COVID-19, including risk mitigation strategies, adjusting capitation rates, covering COVID-19 costs on a non-risk basis, and carving out costs related to COVID-19 from MCO contracts (Figure 2). These options vary widely in terms of implementation/operational complexity, and all options will require CMS approval. Additionally, there is still a lot of uncertainty about the impact of the pandemic on managed care financing/rates, particularly in current plan rating periods (which typically run on a calendar year or state fiscal year basis), as it’s still too early to know if there is pent up demand that may drive utilization upward as the pandemic abates as well as unknowns about where/when COVID-19 cases and related costs will spike as the pandemic continues.

Figure 2: CMS has provided guidance to states to address MCO payment issues in response to the COVID-19 pandemic

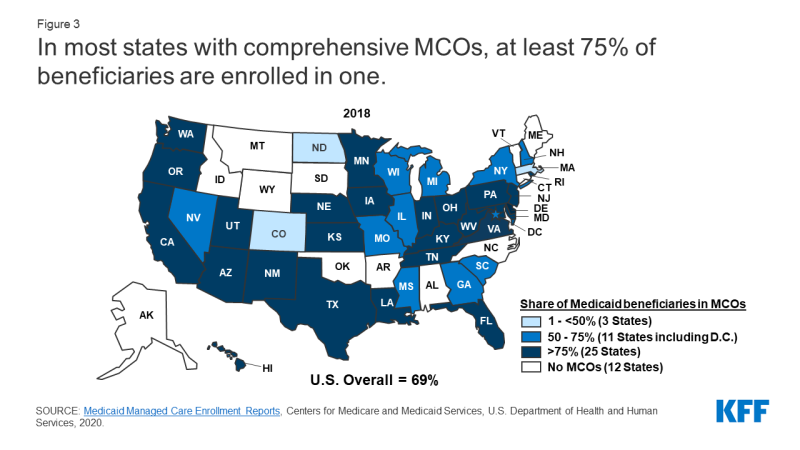

3. As of July 2018, over two-thirds (69%) of all Medicaid beneficiaries received their care through comprehensive risk-based MCOs.

As of July 2018, 53.9 million Medicaid enrollees received their care through risk-based MCOs. Twenty-five MCO states covered more than 75% of Medicaid beneficiaries in MCOs (Figure 3).

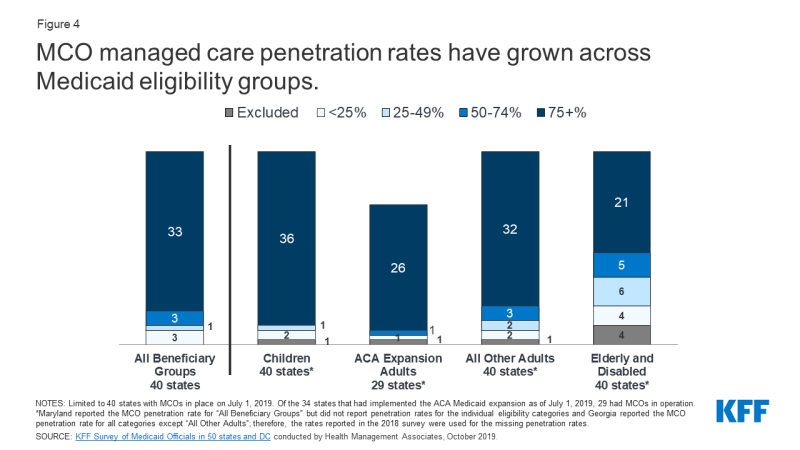

4. Children and adults are more likely to be enrolled in MCOs than seniors or persons with disabilities; however, states are increasingly including beneficiaries with complex needs in MCOs.

As of July 2019, 36 MCO states reported covering 75% or more of all children through MCOs (Figure 4). Of the 34 states that had implemented the ACA Medicaid expansion as of July 2019, 29 were using MCOs to cover newly eligible adults and the large majority of these states covered more than 75% of beneficiaries in this group through MCOs. Thirty-two MCO states reported covering 75% or more of low-income adults in pre-ACA expansion groups (e.g., parents, pregnant women) through MCOs. In contrast, only 21 MCO states reported coverage of 75% or more of seniors and people with disabilities. Although this group is still less likely to be enrolled in MCOs than children and adults, over time, states have been moving to include seniors and people with disabilities in MCOs.

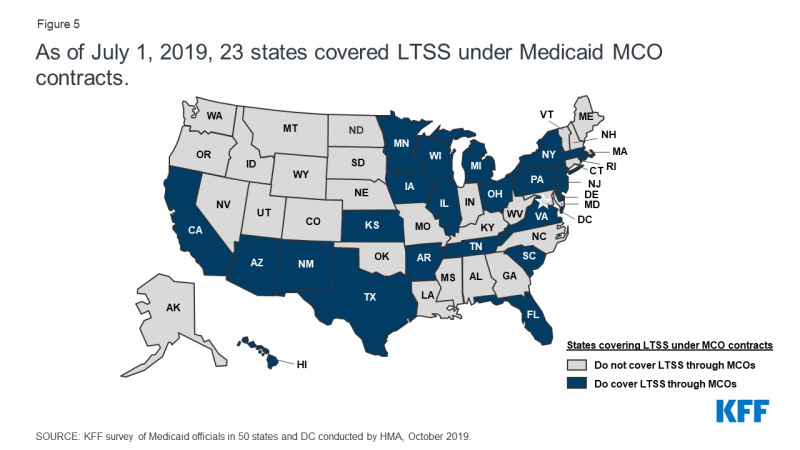

5. In recent years, many states have moved to carve in behavioral health services, pharmacy benefits, and long-term services and supports to MCO contracts.

Although MCOs provide comprehensive services to beneficiaries, states may carve specific services out of MCO contracts to fee-for-service (FFS) systems or limited benefit plans. Services frequently carved out include behavioral health, pharmacy, dental, and long-term services and supports (LTSS). However, there has been significant movement across states to carve these services in to MCOs. As of July 2019, twenty-three states also covered LTSS through Medicaid MCO arrangements for at least some LTSS populations (Figure 5).

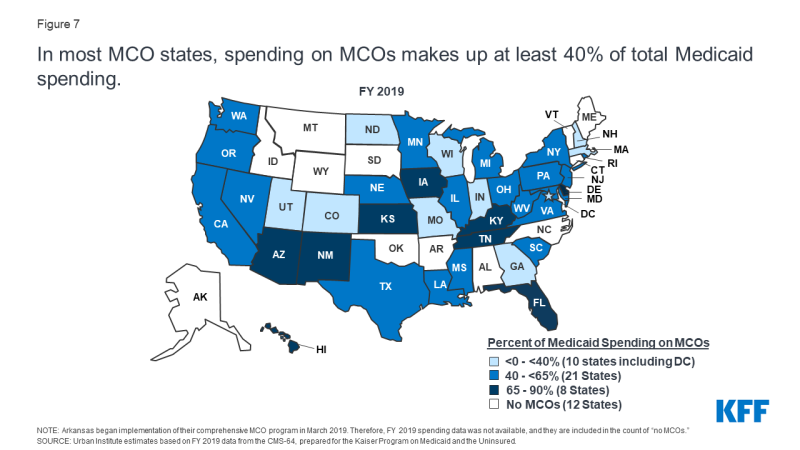

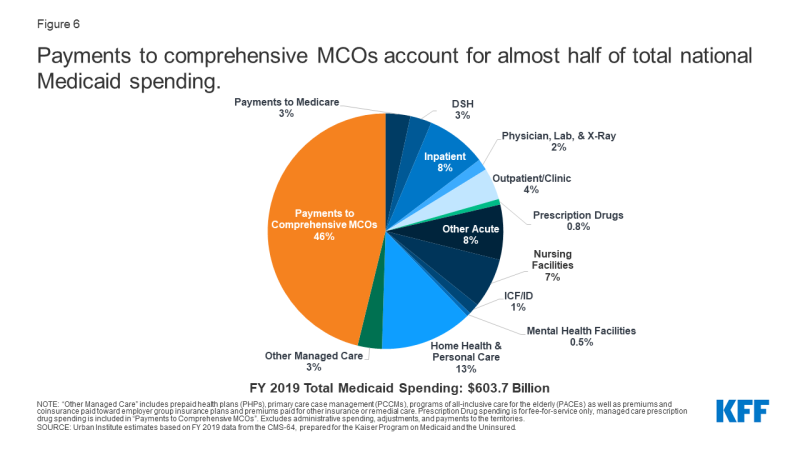

6. In FY 2019, payments to comprehensive risk-based MCOs accounted for the largest share of Medicaid spending.

In FY 2019, state and federal spending on Medicaid services totaled nearly $604 billion. Payments made to MCOs accounted for about 46% of total Medicaid spending (Figure 6). The share of Medicaid spending on MCOs varies by state, but about three-quarters of MCO states directed at least 40% of total Medicaid dollars to payments to MCOs (Figure 7). The MCO share of spending ranged from a low of 0.4% in Colorado to 87% in Kansas.8 State-to-state variation reflects many factors, including the proportion of the state Medicaid population enrolled in MCOs, the health profile of the Medicaid population, whether high-risk/high cost beneficiaries (e.g., persons with disabilities, dual eligible beneficiaries) are included in or excluded from MCO enrollment, and whether or not long-term services and supports are included in MCO contracts. As states expand Medicaid managed care to include higher-need, higher-cost beneficiaries, expensive long-term services and supports, and adults newly eligible for Medicaid under the ACA, the share of Medicaid dollars going to MCOs will continue to increase.

Figure 6: Payments to comprehensive MCOs account for almost half of total national Medicaid spending

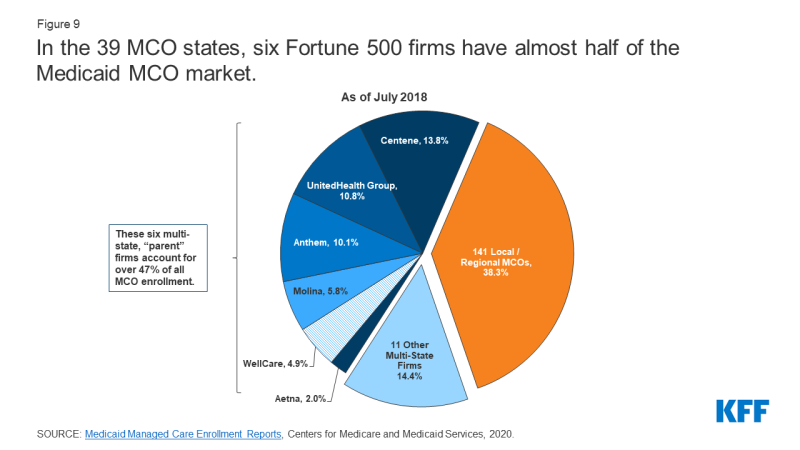

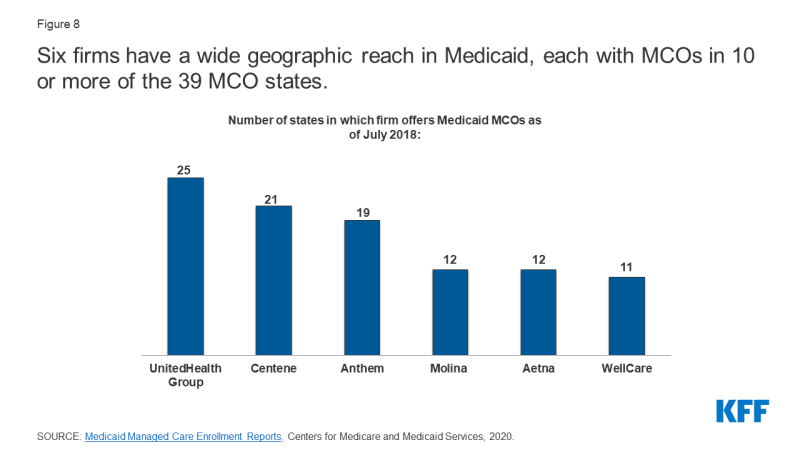

7. A number of large health insurance companies have a significant stake in the Medicaid managed care market.

States contracted with a total of 290 Medicaid MCOs as of July 2018. MCOs represent a mix of private for-profit, private non-profit, and government plans. As of July 2018, a total of 17 firms operated Medicaid MCOs in two or more states (called “parent” firms10), and these firms accounted for nearly 62% of enrollment in 2018 (Figure 9). Of the 17 parent firms, eight are publicly traded, for-profit firms while the remaining nine are non-profit companies. Six firms – UnitedHealth Group, Centene, Anthem, Molina, Aetna, and WellCare – have MCOs in 10 or more states (Figure 8) and accounted for over 47% of all Medicaid MCO enrollment (Figure 9). All six are publicly traded companies ranked in the Fortune 500.12

Figure 8: Six firms have a wide geographic reach in Medicaid, each with MCOs in 10 or more of the 39 MCO states

8. Within broad federal and state rules, plans often have discretion in how to ensure access to care for enrollees and how to pay providers.

Plan efforts to recruit and maintain their provider networks can play a crucial role in determining enrollees’ access to care through factors such as travel times, wait times, or choice of provider. Federal rules require that states establish network adequacy standards. States have a great deal of flexibility to define those standards. The 2016 CMS Medicaid managed care final rule included specific parameters for states in setting network adequacy standards, although regulations proposed by the Trump administration in 2018 would loosen these requirements. KFF conducted a survey of Medicaid managed care plans in 2017 and found that responding plans reported a variety of strategies to address provider network issues, including direct outreach to providers, financial incentives, automatic assignment of members to PCPs, and prompt payment policies. However, despite employing various strategies, plans reported more challenges in recruiting specialty providers than in recruiting primary care providers to their networks. These challenges were more likely due to provider supply shortages than due to low provider participation in Medicaid.

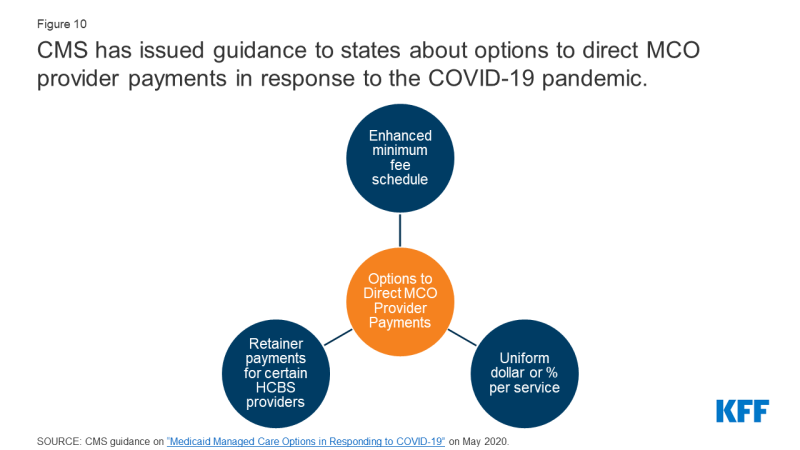

To help ensure participation, many states require minimum provider rates in their contracts with MCOs that may be tied to fee-for-service rates. In a 2019 KFF survey of Medicaid directors, about one-half of MCO states indicated that they mandate minimum provider reimbursement rates in their MCO contracts for inpatient hospital, outpatient hospital, or primary care physicians. In response to the COVID-19 pandemic, many Medicaid providers may be under fiscal strain, facing substantial losses in revenue. For providers in states that rely heavily on managed care, states are making payments to plans but those funds may not be flowing to providers where utilization has decreased. As a result, states are evaluating options and flexibilities under existing managed care rules to direct/bolster payments to Medicaid providers and to preserve access to care for enrollees. States can direct that managed care plans make payments to their network providers using methodologies approved by CMS to further state goals and priorities, including response to the COVID-19 pandemic. For example, states could require plans to adopt a uniform temporary increase in per-service provider payment amounts for services covered under the managed care contract, or states could combine different state directed payments to temporarily increase provider payments (Figure 10).

Figure 10: CMS has issued guidance to states about options to direct MCO provider payments in response to the COVID-19 pandemic

9. Over time, the expansion of risk-based managed care in Medicaid has been accompanied by greater attention to measuring quality and outcomes.

Nearly all MCO states reported using at least one select Medicaid managed care quality initiative in FY 2019 (Figure 11). More than three quarters of MCO states (34 of 40) reported having initiatives in place in FY 2019 that make MCO comparison data publicly available (up from 23 states in 2014). More than half of MCO states reported capitation withhold arrangements (24 of 40) and/or pay for performance incentives (25 of 40) in FY 2019. States that use a pay for performance bonus or penalty, a capitation withhold, and/or an auto-assignment quality factor report linking these quality initiatives to a variety of performance measure focus areas. Over three quarters of MCO states (31 states) reported using chronic disease management metrics when rewarding or penalizing plan performance (Figure 11).16 More than half of MCO states reported linking quality initiatives to perinatal/birth outcome measures (26 states) or mental health measures (24 states). These focus areas are not surprising given the chronic physical health and behavioral health needs of the Medicaid population, as well as the significant share of the nation’s births funded by Medicaid. In response to the COVID-19 pandemic, states may need to revisit MCO contract provisions, including quality measurement requirements, as the pandemic is likely to affect clinical practices and timely reporting of quality data.

Figure 11: States are implementing an array of quality initiatives within MCO contracts and linking these initiatives to a variety of performance measure focus areas

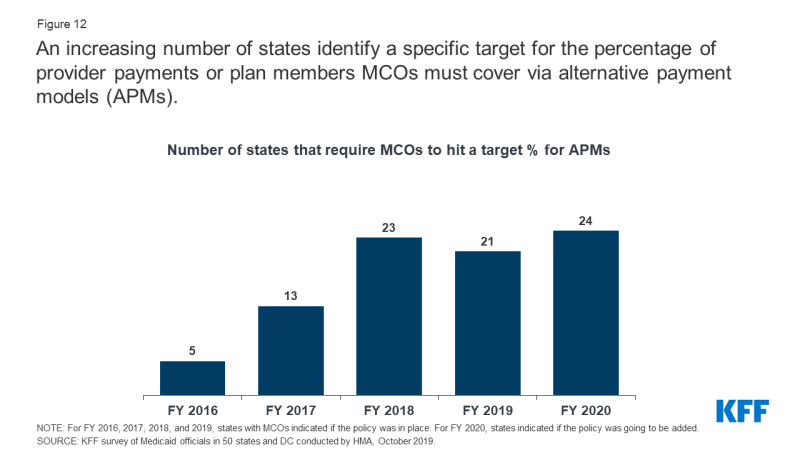

Alternative payment models (APMs) replace FFS/volume-driven provider payments with payment models that incentivize quality, coordination, and value (e.g., shared savings/shared risk arrangements and episode-based payments). More than half of MCO states (21 of 40) set a target percentage in their MCO contracts for the percentage of provider payments, network providers, or plan members that MCOs must cover via alternative payment models in FY 2019 (Figure 12). Several states reported that their APM targets were linked to the Health Care Payment Learning & Action Network’s (LAN’s) APM Framework that categorizes APMs in tiers. KFF’s 2017 survey of Medicaid managed care plans found nearly all responding plans reported using at least one alternative payment model for at least some providers. The vast majority of plans use incentives and/or bonus payments tied to performance measures. Fewer plans reported using bundled or episode-based payments or shared savings and risk arrangements.

Figure 12: An increasing number of states identify a specific target for the percentage of provider payments or plan members MCOs must cover via alternative payment models (APMs)

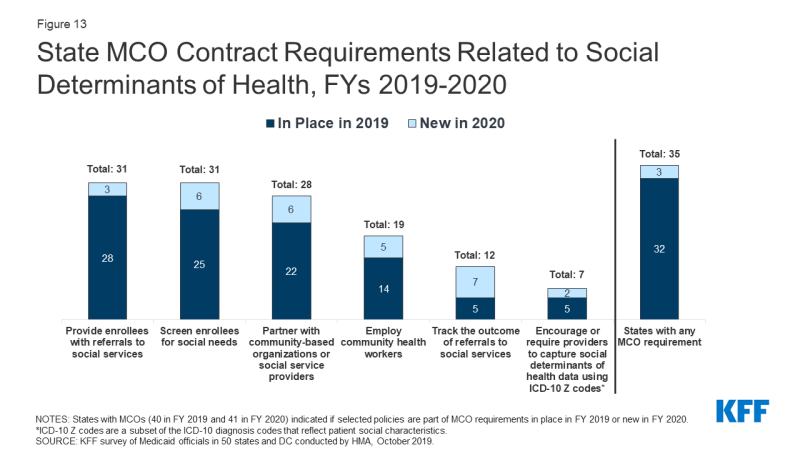

10. States are looking to Medicaid MCOs to develop strategies to identify and address social determinants of health.

Many states are leveraging MCO contracts to promote strategies to address social determinants of health. For FY 2020, over three-quarters (35 states) of the 41 MCO states reported leveraging Medicaid MCO contracts to promote at least one strategy to address social determinants of health (Figure 13). For FY 2020, about three-quarters of MCO states reported requiring MCOs to screen enrollees for social needs (31 states); providing enrollees with referrals to social services (31 states); or partnering with community-based organizations (28 states). Almost half of MCO states reported requiring MCOs to employ community health workers (CHWs) or other non-traditional health workers (19 states). KFF’s 2017 survey of Medicaid managed care plans found that a majority of plans were actively working to help beneficiaries connect with social services related to housing, nutrition, education, or employment.

Although federal reimbursement rules prohibit expenditures for most non-medical services, plans may use administrative savings or state funds to provide these services. “Value-added” services are extra services outside of covered contract services and do not qualify as a covered service for the purposes of capitation rate setting. In a 2020 KFF survey of Medicaid directors, MCO states reported a variety of programs, initiatives, or value-added services newly offered by MCOs in response to the COVID-19 emergency. The most frequently mentioned offerings and initiatives were food assistance and home delivered meals (11 states) and enhanced MCO care management and outreach efforts often targeting persons at high risk for COVID-19 infection or complications or persons testing positive for COVID-19 (8 states). Other examples include states reporting MCO provision of personal protective equipment (4 states), expanded MCO telehealth and remote supports (3 states), expanded pharmacy home deliveries (3 states), and MCO-provided gift cards for members to purchase food and other goods (2 states).